betkubi online casino Photo from Pagasa MANILA, Philippines — Work in gove...

When elections officials in Palm Beach County, Fla., emailed ballots last week t...

" class="attachment-full size-full" alt="Online sellers' slay suspects conf...

Uttar Pradesh's Nitish Rana (left) in Syed Mushtaq Ali Trophy 2023 action ag...

India beat Pakistan by seven wickets in their previous T20I encounter. Photo: AP...

|

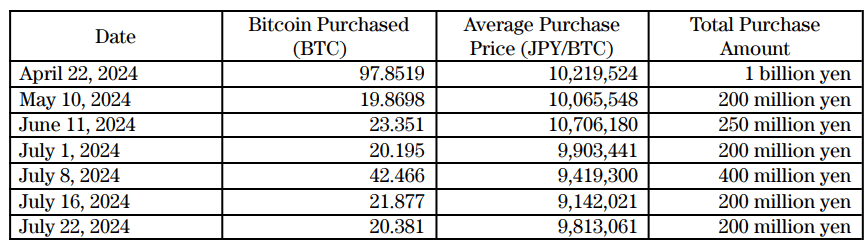

Bitcoin investment firm Metaplanet is set to raise ¥10.08 billion (approximately $70 million) by offering its 11th series of stock acquisition rights to all common shareholders.maswerte In an Aug. 6 statement, the Japanese company outlined plans to allocate ¥8.5 billion (around $58.76 million) of this raised funds to purchase additional Bitcoin. The firm said it would distribute one stock acquisition right per common share to shareholders, as recorded on Sept. 5. These rights permit shareholders to acquire Metaplanet stock at a price of ¥555 (around $4) between Sept. 6 and Oct. 15. The new funding will enable the company to significantly expand its Bitcoin holdings, aligning with its long-term growth strategy. Metaplanet currently holds about 246 BTC, valued at around $13.4 million.  Metaplanet Bitcoin Purchases (Source: Metaplanet) Metaplanet Bitcoin Purchases (Source: Metaplanet)Meanwhilemaswerte, Metaplanet’s move is straight from the playbook of MicroStrategy, a business intelligence firm that has accumulated over 220,000 Bitcoins through debt and equity raises since 2020. Bitcoin pivotMetaplanet plans to use the funds raised primarily to acquire Bitcoin and invest in related sectors. The firm restated its belief in the flagship digital asset’s long-term potential despite the recent declines in Bitcoin prices. Furthermore, it highlighted BTC’s strength as a hedge against currency depreciation, particularly the yen, which has recently depreciated massively against the US Dollar. Metaplanet stated: “An increase in Bitcoin prices is expected to strengthen our balance sheet, enhance asset value, and positively contribute to our earnings.” The company revealed that it was considering potential future business ventures within the BTC ecosystem, adding that it could generate additional income from its Bitcoin holdings by selling covered calls on the flagship digital assets. Metaplanet’s shift towards Bitcoin comes as it has strategically exited most of its hotel business, which had suffered from declining revenue and recurring losses over five consecutive periods. Meanwhile, it suggested that the hotel division could be rejuvenated by transforming it to strategically cater to Bitcoin enthusiasts and businesses while offering unique services and generating additional revenue sources. Mentioned in this article  |